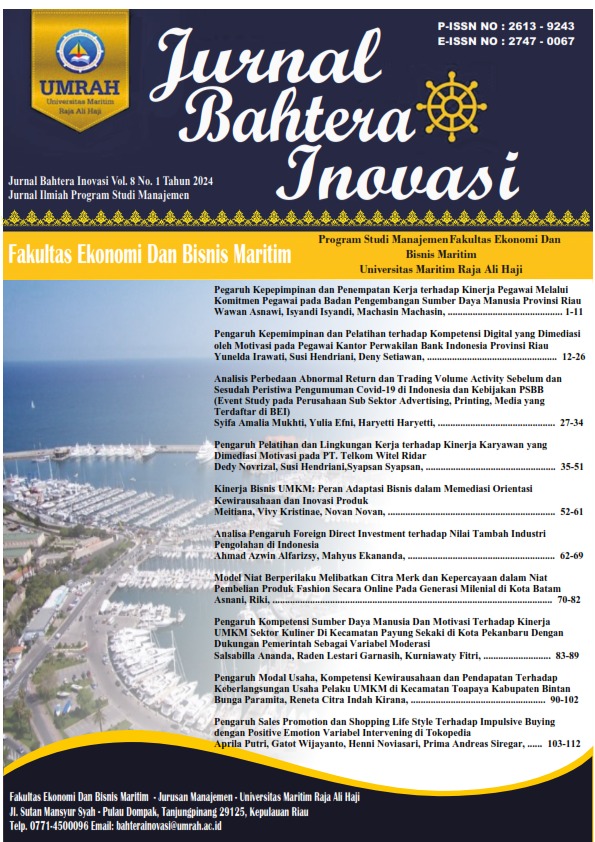

Analisis Perbedaan Abnormal Return dan Trading Volume Activity Sebelum dan Sesudah Peristiwa Pengumuman Covid-19 di Indonesia dan Kebijakan PSBB (Event Study pada Perusahaan Sub Sektor Advertising, Printing, Media yang Terdaftar di BEI)

DOI:

https://doi.org/10.31629/bi.v8i1.5696Keywords:

Covid-19, Psbb, Abnormal Return, Trading Volume ActivityAbstract

This study aims to find out whether before and after the announcement of the first case of Covid-19 in Indonesia and also before and after the announcement of the PSBB policy there were significant differences in the average abnormal return and the average trading volume activity of stock companies in the advertising, printing, and media sub-sector companies. The type of data used in this study is quantitative data with secondary data sources. The population in this study were advertising, printing, media sub-sector companies, totaling 19 companies. The research sample is 12 companies and determined by using judgment sampling method. The data processing method used the Paired Sample T-Test, using SPSS software to process the data. The results showed that there was no significant difference in the average abnormal return and average trading volume activity before and after the announcement of the first case of Covid-19 in Indonesia. And there is no significant difference from the average abnormal return and average trading volume activity before and after the announcement of the PSBB policy.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Bahtera Inovasi

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.