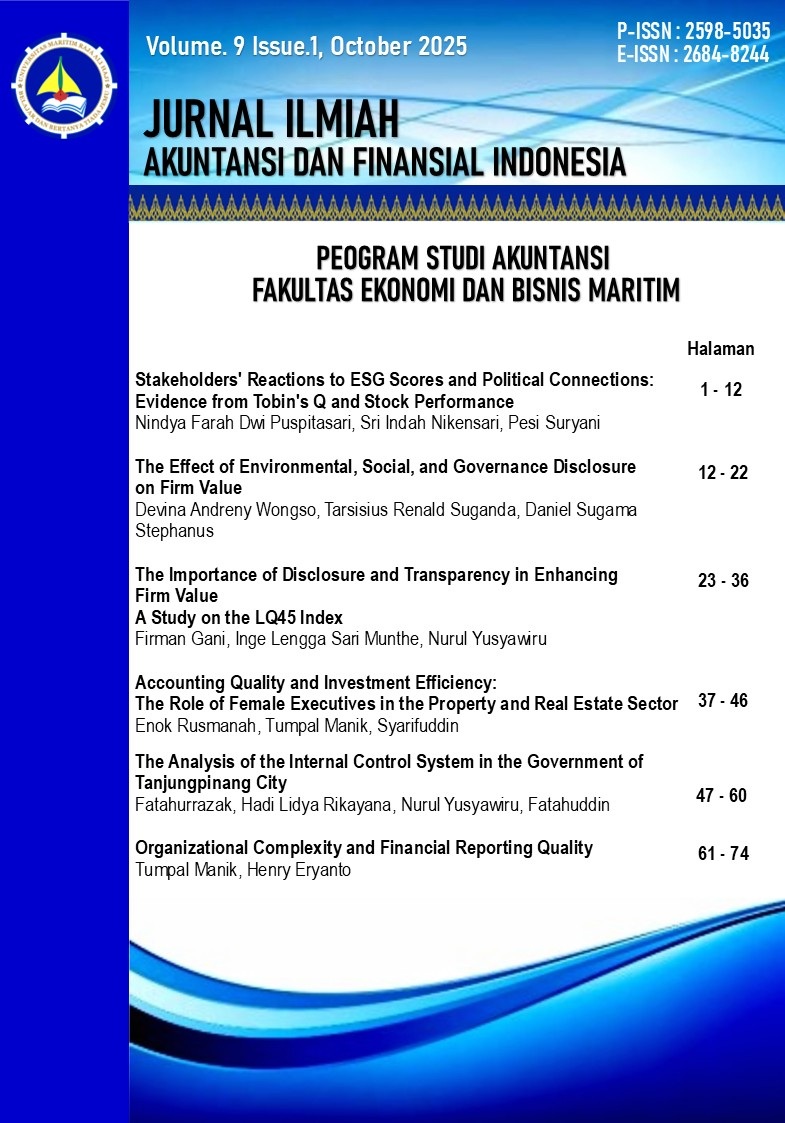

The Effect of Environmental, Social, and Governance Disclosure on Firm Value

DOI:

https://doi.org/10.31629/ahfn0849Keywords:

ESG disclosure, firm value, energy sector, shareholder theoryAbstract

This study examines the effect of ESG disclosure on firm value with a shareholder theory approach. This study uses a quantitative analysis of 147 observations of energy sector companies listed on the Indonesia Stock Exchange from 2021-2023. Firm value as the dependent variable is proxied by Tobin’s Q. The analysis shows that social, economic, and governance disclosures significantly adversely affect firm value. Meanwhile, ERM disclosures have a significant positive effect, while environmental disclosures do not affect firm value. These findings support the shareholder theory that assesses non-financial expenditure as a burden or waste of resources if they do not directly impact increasing profits. The study’s novelty lies in partially testing the five ESG aspects in the energy sector that are sensitive to greenwashing practices and market expectations. This research contributes to the development of ESG literature and provides insights for management and investors in emerging markets.

Downloads

References

Angir, P., & Weli. (2024). The Influence of Environmental, Social, and Governance (ESG) Disclosure on Firm Value: An Asymmetric Information Perspective in Indonesian Listed Companies. Binus Business Review, 15(1), 29–40. https://doi.org/10.21512/bbr.v15i1.10460

Bloomberg Technoz. (2024). BYAN, ADRO Cs Getol Ekspansi, Dituding Greenwashing & Ganggu NZE. https://www.bloombergtechnoz.com/detail-news/40786/byan-adro-cs-getol-ekspansi-dituding-greenwashing-ganggu-nze

Chung, K. H., & Pruitt, S. W. (1994). A Simple Approximation of Tobin’s Q. Source: Financial Management, 23(3), 70–74. http://www.jstor.orgURL:http://www.jstor.org/stable/3665623

CRMS. (2024). Menyoroti Perbedaan Greenwashing dan Sustainability dalam Industri Energi. https://crmsindonesia.org/publications/menyoroti-perbedaan-greenwashing-dan-sustainability-dalam-industri-energi/

Dihardjo, J. F., & Hersugondo, H. (2023). Exploring the Impact of ESG Disclosure, Dividend Payout Ratio, and Institutional Ownership on Firm Value: A Moderated Analysis of Firm Size. Jurnal Ekonomi Bisnis Dan Kewirausahaan, 12(2), 184–207. https://doi.org/10.26418/JEBIK.V12I2.64129

Dwimayanti, N. M. D., Sukartha, P. D. Y., Putri, I. G. A. M. A. D., & Sisdyani, E. A. (2023a). Beyond Profit: How ESG Performance Influences Company Value Across Industries? Jurnal Ilmiah Bidang Akuntansi Dan Manajemen, 20(1), 43–65. https://doi.org/10.31106/jema.v20i1.20574

Elkington, J. (1998). Accounting for the Triple Bottom Line. In Measuring Business Excellence (Vol. 2, Issue 3, pp. 18–22). https://doi.org/10.1108/eb025539

Energika.id. (2024). KPBB Dorong Industri Energi Beranjak dari Greenwashing ke Green Lifestyle. https://energika.id/detail/66301/kpbb-dorong-industri-energi-beranjak-dari-greenwashing-ke-green-lifestyle

ESDM. (2023). Kementerian ESDM Terbitkan HEESI 2022. https://www.esdm.go.id/id/media-center/arsip-berita/kementerian-esdm-terbitkan-heesi-2022

Faisal, F., Abidin, Z., & Haryanto, H. (2021). Enterprise Risk Management (ERM) and Firm Value: The Mediating Role of Investment Decisions. Cogent Economics and Finance, 9(1). https://doi.org/10.1080/23322039.2021.2009090

Firmansyah, A., Husna, M. C., & Putri, M. A. (2021). Corporate Social Responsibility Disclosure, Corporate Governance Disclosures, and Firm Value in Indonesia Chemical, Plastic, and Packaging Sub-Sector Companies. Accounting Analysis Journal, 10(1), 9–17. https://doi.org/10.15294/aaj.v10i1.42102

Friedman, M. (1970). Friedman Doctrine. https://corporatefinanceinstitute.com/resources/equities/friedman-doctrine/

Ghozali, I. (2021). Aplikasi Analisis Multivariate dengan Program IBM SPSS 26. In Aplikasi Analisis Multivariate dengan Program IBM SPSS 25. Badan Penerbit Universitas Diponegoro: Semarang: Vol. XXII (10th ed.). Badan Penerbit Universitas Diponegoro.

GRI. (2023). GRI Standards. https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-bahasa-indonesia-translations/

GRI, & SASB. (2021). A Practical Guide to Sustainability Reporting Using GRI and SASB Standards.

Grisales, E. D., & Caracuel, J. A. (2021). Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. Journal of Business Ethics, 168(2), 315–334. https://doi.org/10.1007/s10551-019-04177-w

Indriastuti, M., Chariri, A., & Fuad, F. (2024). Enhancing Firm Value: The Role of Enterprise Risk Management, Intellectual Capital, and Corporate Social Responsibility. Contaduría y Administración, 70(1), 486. https://doi.org/10.22201/FCA.24488410E.2025.5185

Kompas.com. (2022). Mengenal Greenwashing dan Perusahaan yang Diduga Melakukannya. https://www.kompas.com/cekfakta/read/2022/07/06/171556882/mengenal-greenwashing-dan-perusahaan-yang-diduga-melakukannya?

Kristi, N. M., & Yanto, H. (2020). The Effect of Financial and Non-Financial Factors on Firm Value. Accounting Analysis Journal, 9(2), 131–137. https://doi.org/10.15294/aaj.v8i2.37518

Lestari Kompas.com. (2023a). Aktivis Desak OJK Keluarkan PLTU Batu Bara dari Revisi Taksonomi Hijau. https://lestari.kompas.com/read/2023/09/15/190000186/aktivis-desak-ojk-keluarkan-pltu-batu-bara-dari-revisi-taksonomi-hijau

Lestari Kompas.com. (2023b). Mengenal 17 Tujuan SDGs Pembangunan Berkelanjutan Beserta Penjelasannya. https://lestari.kompas.com/read/2023/05/02/080000486/mengenal-17-tujuan-sdgs-pembangunan-berkelanjutan-beserta-penjelasannya?page=all#page2

Lestari Kompas.com. (2024). Ekspansi Tambang dan Batu Bara Ancam Transisi Energi. https://lestari.kompas.com/read/2024/06/14/072106586/ekspansi-tambang-dan-batu-bara-ancam-transisi-energi?

Lestari Kompas.com. (2024a). IAI Terbitkan Peta Jalan Standar Pengungkapan Keberlanjutan, Perusahaan Bersiap Patuhi. https://lestari.kompas.com/read/2024/12/20/161913486/iai-terbitkan-peta-jalan-standar-pengungkapan-keberlanjutan-perusahaan?page=all#google_vignette

Lestari Kompas.com. (2025). Bursa Efek Indonesia: ESG Aspek Penting dalam Keputusan Investasi. https://lestari.kompas.com/read/2025/02/18/090000386/bursa-efek-indonesia--esg-aspek-penting-dalam-keputusan-investasi

Media Nikel Indonesia. (2025). Purba: Keberlanjutan & Kepatuhan terhadap ESG Perlu Merujuk Standar Internasional. https://nikel.co.id/2025/02/13/purba-keberlanjutan-kepatuhan-terhadap-esg-perlu-merujuk-standar-internasional/

Mutiah, S., & Rusmanto, T. (2023). Impact of Environmental, Social, and Governance (ESG) Disclosures on Firm Value: Study of 5 ASEAN Countries. Economic Affairs, 68(3), 1433–1439. https://doi.org/10.46852/0424-2513.3.2023.11

OJK. (2017). Peraturan Penerapan Keuangan Berkelanjutan bagi Lembaga Jasa Keuangan, Emiten, dan Perusahaan Publik. https://www.ojk.go.id/id/kanal/perbankan/regulasi/peraturan-ojk/Pages/POJK-Penerapan-Keuangan-Berkelanjutan-bagi-Lembaga-Jasa-Keuangan%2C-Emiten%2C-dan-Perusahaan-Publik.aspx

OJK. (2021). Bentuk dan Isi Laporan Tahunan Emiten atau Perusahaan Publik. https://www.ojk.go.id/id/regulasi/Pages/Bentuk-dan-Isi-Laporan-Tahunan--Emiten-atau-Perusahaan-Publik.aspx

Peraturan Menteri BUMN. (2023). Peraturan Menteri Badan Usaha Milik Negara Republik Indonesia Nomor PER-2/MBU/03/2023. www.peraturan.go.id

Permana, S., Aruddy, A., & Jahroh, S. (2023). The Effect of Good Corporate Governance on Company Value Moderated By Integrated Reporting. Jurnal Aplikasi Bisnis Dan Manajemen, 9(3), 805–805. https://doi.org/10.17358/JABM.9.3.805

Prabawati, P. I., & Rahmawati, I. P. (2022). The Effects of Environmental, Social, and Governance (ESG) Scores on Firm Values in ASEAN Member Countries. Jurnal Akuntansi Dan Auditing Indonesia, 26(2), 119–129. https://doi.org/10.20885/jaai.vol26.i

Pramesti, W. C., Sudarma, M., & Ghofar, A. (2024). Environmental, Social, and Governance (ESG) Disclosure, Intellectual Capital and Firm Value: The Moderating Role of Financial Performance. Jurnal Reviu Akuntansi Dan Keuangan, 14(1), 103–121.

Putri, R. N., & Makaryanawati, M. (2022). Enterprise Risk Management, Board Financial Qualification, and Firm Value. Accounting Analysis Journal, 11, 149–157. https://doi.org/10.15294/AAJ.V11I3.61469

Riyadh, H. A., Al-Shmam, M. A., & Firdaus, J. I. (2022). Corporate Social Responsibility and GCG Disclosure on Firm Value with Profitability. International Journal of Professional Business Review, 7(3), e0655. https://doi.org/10.26668/businessreview/2022.v7i3.e655

Rohendi, H., Ghozali, I., & Ratmono, D. (2024). Environmental, Social, and Governance (ESG) Disclosure and Firm Value: The Role of Competitive Advantage as a Mediator. Cogent Business and Management, 11(1), 1–18. https://doi.org/10.1080/23311975.2023.2297446

Rosyid, M. F., Saraswati, E., & Ghofar, A. (2022). Firm Value: CSR Disclosure, Risk Management And Good Corporate Governance Dimensions. Jurnal Reviu Akuntansi Dan Keuangan, 12(1), 186–209. https://doi.org/10.22219/JRAK.V12I1.18731

Sadiq, M., Singh, J., Raza, M., & Mohamad, S. (2020). The Impact of Environmental, Social, and Governance Index on Firm Value: Evidence from Malaysia. International Journal of Energy Economics and Policy, 10(5), 555–562. https://doi.org/10.32479/ijeep.10217

Sastroredjo, P. E., & Suganda, T. R. (2025). ESG and Financial Distress: The Role of Bribery, Corruption, and Fraud in FTSE All-Share Companies. Risks, 13(3), 41. https://doi.org/10.3390/RISKS13030041

Setiabudhi, H., Suwono, Setiawan, Y. A., & Karim, S. (2025). Analisis Data Kuantitatif dengan SmartPLS 4. Borneo Novelty Publishing.

Suryati, S., & Murwaningsari, E. (2022). Pengaruh Green Competitive Advantage dan Pelaporan Terintegrasi Terhadap Nilai Perusahaan. Akurasi : Jurnal Studi Akuntansi Dan Keuangan, 5(2), 193–208. https://doi.org/10.29303/AKURASI.V5I2.237

Sutrisno, S. (2020). Corporate Governance, Profitability, and Firm Value Study on the Indonesian Sharia Stock Index. Jurnal Ekonomi Dan Bisnis Islam, 6(2), 292–303. https://doi.org/10.20473/JEBIS.V6I2.23231

Tsang, A., Frost, T., & Cao, H. (2023). Environmental, Social, and Governance (ESG) Disclosure: A Literature Review. British Accounting Review, 55(1). https://doi.org/10.1016/j.bar.2022.101149

Downloads

Published

Issue

Section

URN

License

Copyright (c) 2025 Jurnal Ilmiah Akuntansi dan Finansial Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.