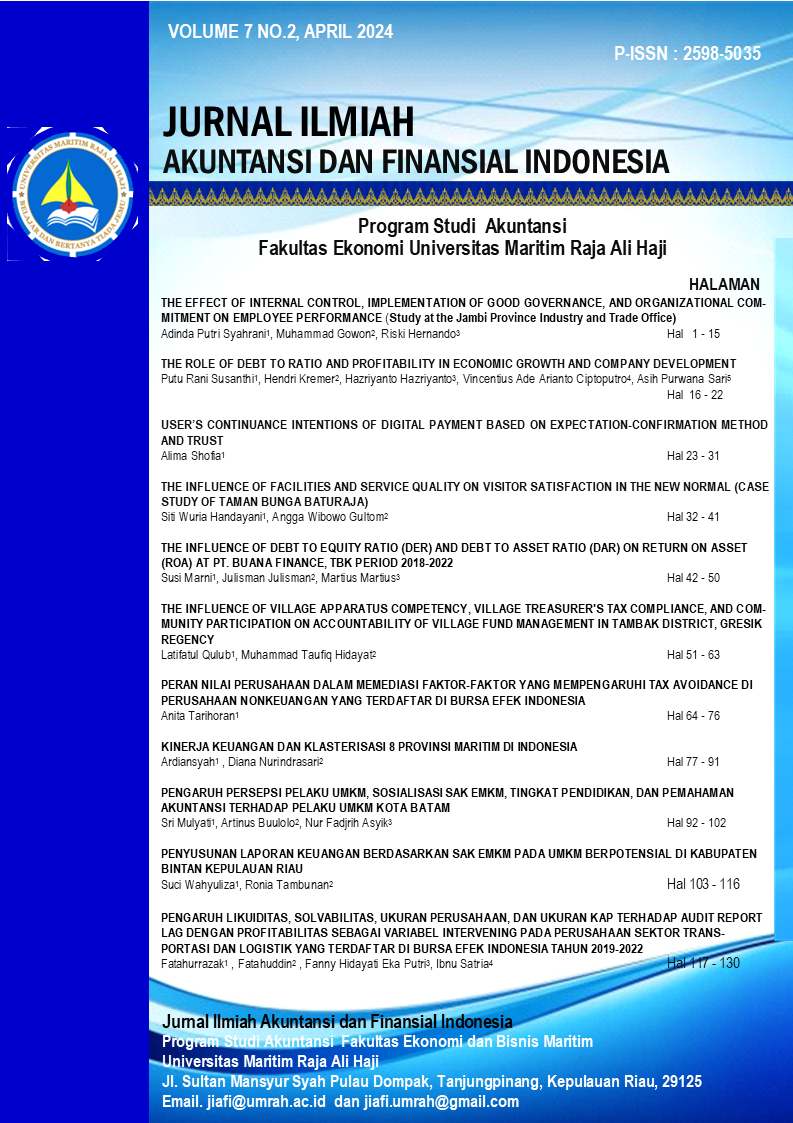

The Influence of Debt to Equity Ratio (DER) and Debt to Asset Ratio (DAR) on Return on Asset (ROA) at PT. Buana Finance, Tbk Period 2018-2022

DOI:

https://doi.org/10.31629/jiafi.v7i2.6647Keywords:

debt to equity ratio, debt to asset ratio, return on assetsAbstract

This study aims to determine the effect of capital structure on the level of assets (profitability). The population of this study was conducted in the multi-finance sector, namely PT Buana Finance which was listed on the Indonesia Stock Exchange (IDX) with a sample period of 2018 - 2022. This type of research was quantitative research. The analysis technique used in the study was the SEM-PLS application which was carried out by model analysis test. construction and path analysis. The results of this study indicate that the value of the R-Square model gives a value of 0.991, both for the DAR variable which is influenced by the DER in the model of 99.1%. The value of the R-Square of ROA is 0.754 either or 75.4% of the variation in profitability (ROA) is influenced by DAR and DER. The remaining 24.6% is influenced by factors other than the second variable. The results of testing the DER hypothesis have no effect on ROA. DAR has a negative and significant effect on ROA. DER has a significant effect on DAR.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Jurnal Ilmiah Akuntansi dan Finansial Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.